Four construction industry CEOs were among the 200 best-compensated chiefs of publicly-held companies valued at $1 billion or more on this year's list compiled by compensation consultant Equilar Inc. for The New York Times, based on 2014 proxy statements filed by April 30.

在这些首席执行官中,一个是名单和他的行业公司职位的新来者,而另一个则利用了股票价值提高和慷慨的长期薪酬方案。数据基于向美国证券交易委员会(SEC)提交的要求的申请。

加利福尼亚承包商导师 - 佩里尼(Tutor-Perini)首席执行官罗纳德·N·泰勒(Ronald N. Tutor)成为该行业最高的行业首席执行官,将该名单放大至39号,据报道,2014年的薪酬为2550万美元。根据Equilar的说法,股票和期权奖励的大部分薪水比去年增长了193%。长期薪酬约占他总数的2120万美元。

The Times reports that the firm's revenue rose 8% last year to $4.5 billion, ranking it at No. 146 on that list component, but that its stock return was down by an equal amount, landing it at No. 171 for that component, with 56% of shareholders voting against Tutor's executive pay.

Leading the Equilar-Times list for 2014 among company CEOs in all areas of business is David M. Zaslav, chief of Discovery Communications, whose total package exceeded $156 million, and was a 368% increase for him from last year, fueled by a long-term compensation bonanza.

AECOM的首席执行官Michael S. Burke首次加入该名单,他于2013年底被提升到该职位。他的300万美元现金薪酬已获得超过1000万美元的股票和期权奖励的增强。该公司在2014年对URS Corp.的大片购买以及相关收购Hunt Construction推动的8%股票收益产生。Equilar数据说,AECOM的收入增长了2%。

排名前200名的其他建筑行业名称来自设备领域 - Caterpillar首席执行官Douglas Oberhelman,排名第132名,总薪酬为1510万美元 - 增长了26%,equilar和Deere的首席执行官Samuel R.他的1710万美元的总薪水使他排名第106。该数字比去年的数字下降了5%,尽管该公司的股票收益增长了7%。

Energy contractor CB&I paid CEO Philip K. Asherman about $14.28 million in 2014, according to the firm's proxy filed on March 27, although he was not included on the Equilar-NYTimes list. The figure was a 3% total compensation drop from 2013, says the proxy.

位于加利福尼亚州红伍德市的Equilar不包括该公司。研究公司的治理总监。“对于在美国境外成立但基本上是美国公司的公司,我们确实有一些例外,但是CB&我没有通过该过滤器。”

The firm's share price doubled in value in 2013 after its purchase of The Shaw Group. Asherman's compensation had been fueled by a stock component that made up 57.4% of the total and rose 70% from the year before.

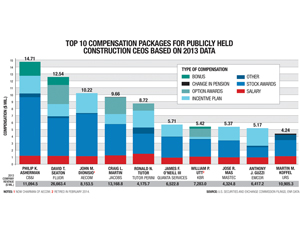

The 10 most highly compensated CEOs last year enjoyed incentive and non-incentive stock awards ranging from 28% to nearly 60% of total pay, according to ENR's analysis of 2013 SEC compensation data. Total pay for MasTec CEO José Mas rose to $5.3 million in 2013 from $481,380 in 2006, as the firm's revenue reached a record $4.3 billion last year and earnings zoomed to $449 million from $60 million in 2007.

ENR also found that only EMCOR paid CEO Anthony J. Guzzi more in cash, with just $1.47 million, or 28.4%, of the total in stock for 2013. Most of his compensation was from the firm's incentive program, which embraces a pay-for-performance approach.

行业招聘人员弗雷德里克·霍恩伯格(Frederick Hornberger)说:“公司认识到,首席执行官,顶级狗,决定了公司的成功或失败,因此他们有点做他们必须做的事情。”Robert W. Baird&Co。的E&C部门分析师Andrew Wittman说,一些薪酬包“鼓励收购活动”。

2013年的SEC数据还包括导师佩里尼(Tutor Perini)的导师150小时的个人使用,价值80万美元,前URS负责人Martin M. Koffel授予了560,000美元的个人安全奖励,该公司的董事由于“与业务相关”的威胁而要求。维特曼说:“行政级别仍然有一些不错的特权……但是,长期,其中大部分是倒塌的。”

科弗尔(Koffel)在AECOM购买后从公司购买后退休,2013年的收入比2010年少34%,反映了较弱的URS结果。他的薪水还反映了自2007年以来基于激励奖的波动。